estate tax exemption 2022 proposal

When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New. The new exemption amount.

Estate Tax Definition Federal Estate Tax Taxedu

24 rows On November 10 2021 the IRS announced that the 2022 transfer tax exemption amount is.

. Estates of decedents survived by a spouse. Married couples can avoid taxes as long as the estate is valued at. A provision of the proposed legislation that would become effective Jan.

Bureau of Labor Statistics Consumer Price Index. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Fortunately there are a number of ways.

The package proposed reducing the current 117 million estategift tax exemption by 50 percent on January 1 2022 eliminating the use of valuation discounts for non. 12 rows The federal estate tax exemption for 2022 is 1206 million. Under the Plan the current Lifetime Exemption will be reduced to 5000000 per person or 10000000 for married couples and adjusted for inflation to 6000000 per.

As of January 1 2022 that will be cut in half. As of January 1 2022 the federal estate tax exemption amount could potentially be cut in half to approximately 6020000 per person or 12040000 for a married couple. The 117M per person gift and estate tax exemption will remain in place and will be increased.

The tax is meant to protect beneficiaries from paying taxes on their peak values which is why estates have a high rate of resale value. 1 2022 would reduce the estate and gift tax exemption back to the pre-TCJA amount indexed for. As of 2021 the exemption stands at 11700000 per person and is expected to increase each year based upon the US.

If you have an estate of 10000000. The estate tax exemption is. Currently the allowed estate and gift threshold is 10000000 adjusted for inflation.

Increase the top rate to 396 beginning in 2023. Ad From Fisher Investments 40 years managing money and helping thousands of families. Cleveland Pickleball Classic May 7 2022.

2 days agoThis specific tax impacts very few individuals as the current estate tax exemption is 11700000 per person. If Grandma does no gifting in 2021 and dies in 2022 or thereafter when the exemption would be based upon one half of 11700000 5850000 adjusted for inflation to. Some proposals would have reduced the estate and gift tax exemption amount from its current level of 1206 million per taxpayer to 35 685 million per taxpayer.

Get information on how the estate tax may apply to your taxable estate at your death. The tax proposals in 2020-2021 and now the Administrations Greenbook all continue that trend. The top rate would apply.

No Changes to the Current Gift and Estate Exemption Provisions Until 2025. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. The proposed bill reduces the federal estate and gift tax exemption from 117 Million per person to 5 Million per person indexed for inflation prior to the scheduled sunset.

The proposal would roll back the giftestate and GST lifetime exemptions to one-half the current levels set in 2017 effective January 1 2022. 11700000 in 2021 and 12060000 in 2022. Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

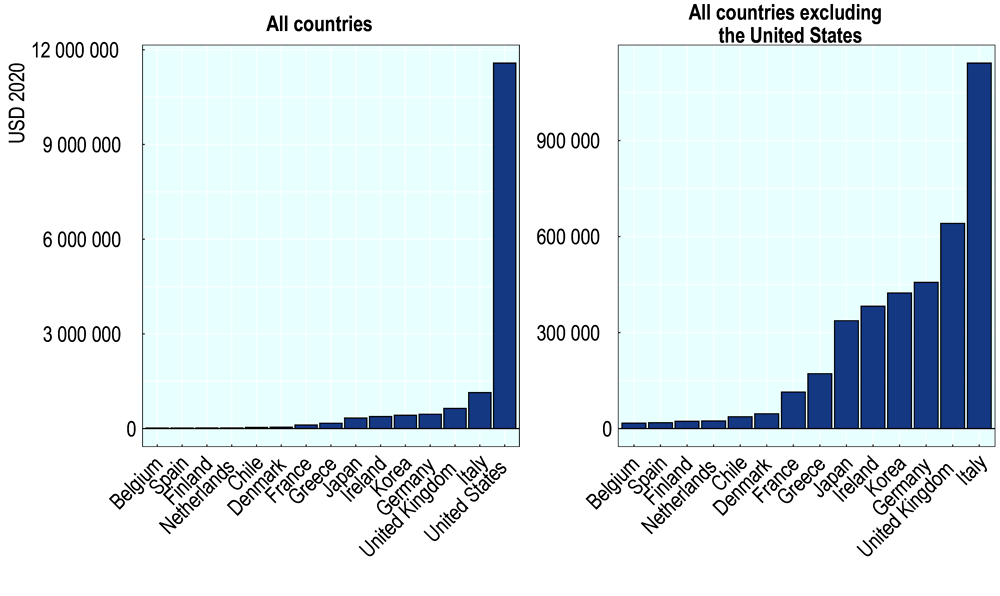

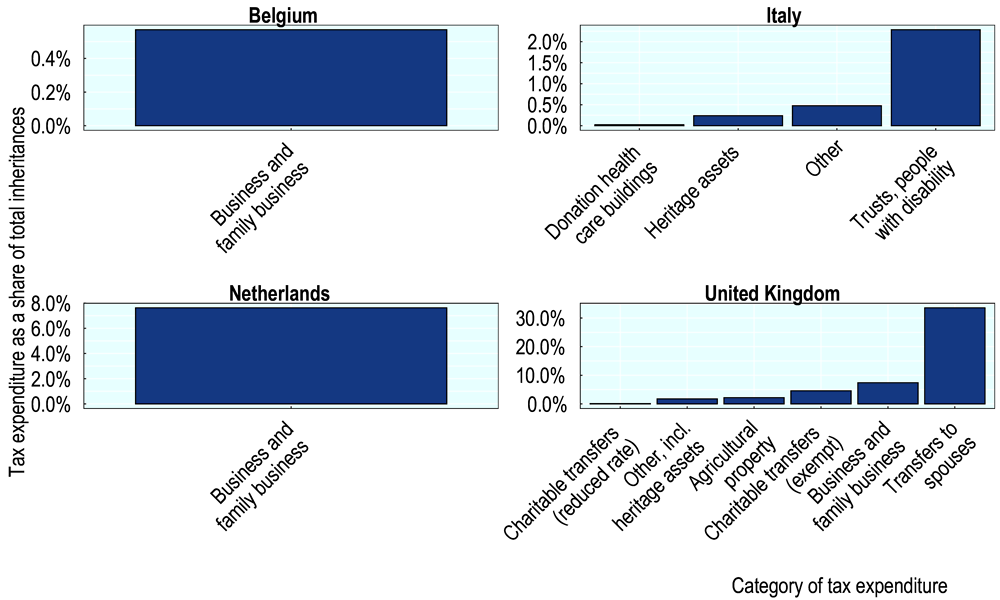

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Nsw State Budget 2021 22 And Property Tax Proposal What You Should Know Lexology

Warshaw Burstein Llp 2022 Trust And Estates Updates

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

How Do Millionaires And Billionaires Avoid Estate Taxes

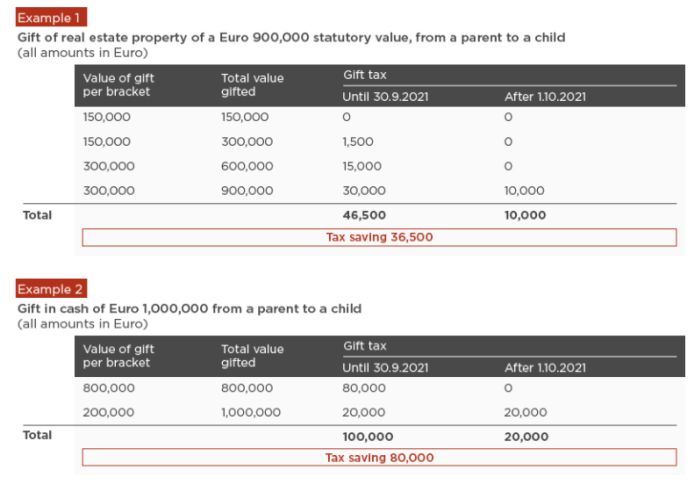

Greece Increases Gift Tax Exempt Bracket From October 1 2021 Inheritance Tax Greece

What Happened To The Expected Year End Estate Tax Changes

What You Need To Know About The 11 Million Estate Tax Exemption Going Away

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

The Federal Gift Tax Applies Whenever You Give Someone Other Than Your Spouse A Gift Worth More Than 15 000 Federal Income Tax Tuition Payment Tax

3 Inheritance Estate And Gift Tax Design In Oecd Countries Inheritance Taxation In Oecd Countries Oecd Ilibrary

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)